More and more security holes are appearing in cryptocurrency and smart contract platforms, and some are fundamental to the way they were built.

Early last month, the security team at Coinbase noticed something strange going on in Ethereum Classic, one of the cryptocurrencies people can buy and sell using Coinbase’s popular exchange platform. Its blockchain, the history of all its transactions, was under attack.

An attacker had somehow gained control of more than half of the network’s computing power and was using it to rewrite the transaction history. That made it possible to spend the same cryptocurrency more than once—known as “double spends.” The attacker was spotted pulling this off to the tune of $1.1 million. Coinbase claims that no currency was actually stolen from any of its accounts. But a second popular exchange, Gate.io, has admitted it wasn’t so lucky, losing around $200,000 to the attacker (who, strangely, returned half of it days later).

Just a year ago, this nightmare scenario was mostly theoretical. But the so-called 51% attack against Ethereum Classic was just the latest in a series of recent attacks on blockchains that have heightened the stakes for the nascent industry.

In total, hackers have stolen nearly $2 billion worth of cryptocurrency since the beginning of 2017, mostly from exchanges, and that’s just what has been revealed publicly. These are not just opportunistic lone attackers, either. Sophisticated cybercrime organizations are now doing it too: analytics firm Chainalysis recently said that just two groups, both of which are apparently still active, may have stolen a combined $1 billion from exchanges.

We shouldn’t be surprised. Blockchains are particularly attractive to thieves because fraudulent transactions can’t be reversed as they often can be in the traditional financial system. Besides that, we’ve long known that just as blockchains have unique security features, they have unique vulnerabilities. Marketing slogans and headlines that called the technology “unhackable” were dead wrong.

That’s been understood, at least in theory, since Bitcoin emerged a decade ago. But in the past year, amidst a Cambrian explosion of new cryptocurrency projects, we’ve started to see what this means in practice—and what these inherent weaknesses could mean for the future of blockchains and digital assets.

How do you hack a blockchain?

Before we go any further, let’s get a few terms straight…..

Image Credit: Amanda Scott – Alias Studio Sydney

News This Week

Nanocrystals Carrying Radioisotopes Offer New Hope for Cancer Treatment

The Science Scientists have developed tiny nanocrystal particles made up of isotopes of the elements lanthanum, vanadium, and oxygen for use in treating cancer. These crystals are smaller than many microbes and can carry isotopes of [...]

New Once-a-Week Shot Promises Life-Changing Relief for Parkinson’s Patients

A once-a-week shot from Australian scientists could spare people with Parkinson’s the grind of taking pills several times a day. The tiny, biodegradable gel sits under the skin and releases steady doses of two [...]

Weekly injectable drug offers hope for Parkinson’s patients

A new weekly injectable drug could transform the lives of more than eight million people living with Parkinson's disease, potentially replacing the need for multiple daily tablets. Scientists from the University of South Australia [...]

Most Plastic in the Ocean Is Invisible—And Deadly

Nanoplastics—particles smaller than a human hair—can pass through cell walls and enter the food web. New research suggest 27 million metric tons of nanoplastics are spread across just the top layer of the North [...]

Repurposed drugs could calm the immune system’s response to nanomedicine

An international study led by researchers at the University of Colorado Anschutz Medical Campus has identified a promising strategy to enhance the safety of nanomedicines, advanced therapies often used in cancer and vaccine treatments, [...]

Nano-Enhanced Hydrogel Strategies for Cartilage Repair

A recent article in Engineering describes the development of a protein-based nanocomposite hydrogel designed to deliver two therapeutic agents—dexamethasone (Dex) and kartogenin (KGN)—to support cartilage repair. The hydrogel is engineered to modulate immune responses and promote [...]

New Cancer Drug Blocks Tumors Without Debilitating Side Effects

A new drug targets RAS-PI3Kα pathways without harmful side effects. It was developed using high-performance computing and AI. A new cancer drug candidate, developed through a collaboration between Lawrence Livermore National Laboratory (LLNL), BridgeBio Oncology [...]

Scientists Are Pretty Close to Replicating the First Thing That Ever Lived

For 400 million years, a leading hypothesis claims, Earth was an “RNA World,” meaning that life must’ve first replicated from RNA before the arrival of proteins and DNA. Unfortunately, scientists have failed to find [...]

Why ‘Peniaphobia’ Is Exploding Among Young People (And Why We Should Be Concerned)

An insidious illness is taking hold among a growing proportion of young people. Little known to the general public, peniaphobia—the fear of becoming poor—is gaining ground among teens and young adults. Discover the causes [...]

Team finds flawed data in recent study relevant to coronavirus antiviral development

The COVID pandemic illustrated how urgently we need antiviral medications capable of treating coronavirus infections. To aid this effort, researchers quickly homed in on part of SARS-CoV-2's molecular structure known as the NiRAN domain—an [...]

Drug-Coated Neural Implants Reduce Immune Rejection

Summary: A new study shows that coating neural prosthetic implants with the anti-inflammatory drug dexamethasone helps reduce the body’s immune response and scar tissue formation. This strategy enhances the long-term performance and stability of electrodes [...]

Scientists discover cancer-fighting bacteria that ‘soak up’ forever chemicals in the body

A family of healthy bacteria may help 'soak up' toxic forever chemicals in the body, warding off their cancerous effects. Forever chemicals, also known as PFAS (per- and polyfluoroalkyl substances), are toxic chemicals that [...]

Johns Hopkins Researchers Uncover a New Way To Kill Cancer Cells

A new study reveals that blocking ribosomal RNA production rewires cancer cell behavior and could help treat genetically unstable tumors. Researchers at the Johns Hopkins Kimmel Cancer Center and the Department of Radiation Oncology and Molecular [...]

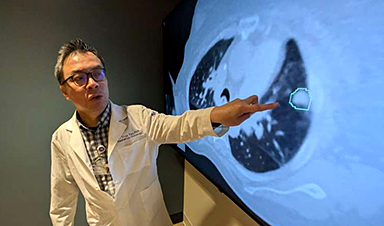

AI matches doctors in mapping lung tumors for radiation therapy

In radiation therapy, precision can save lives. Oncologists must carefully map the size and location of a tumor before delivering high-dose radiation to destroy cancer cells while sparing healthy tissue. But this process, called [...]

Scientists Finally “See” Key Protein That Controls Inflammation

Researchers used advanced microscopy to uncover important protein structures. For the first time, two important protein structures in the human body are being visualized, thanks in part to cutting-edge technology at the University of [...]

AI tool detects 9 types of dementia from a single brain scan

Mayo Clinic researchers have developed a new artificial intelligence (AI) tool that helps clinicians identify brain activity patterns linked to nine types of dementia, including Alzheimer's disease, using a single, widely available scan—a transformative [...]

Leave A Comment